Insurance Underwriting Analytics Overview

Underwriting in the insurance industry is based on claim experience from different portfolio and segment which relates to premiums and exposures. Traditionally, underwriters use relational data while Underwriting Analytics in insurance policy such as Vehicle type and driver age for motor insurance, building type and floor for home insurance, occupation and health status for health and accident insurance, these methods may not be relevant in today context. To determine insurance risk correctly, underwriters needs to analyze specific risk parameters in relation to claim experiences for each product segment.

Insurance Underwriting Analytics provides comprehensive analytic solutions for prudent Underwriting. With the help of Insurance Analytics(IA+), the underwriters can analyze specific risk parameter of new policies / customer portfolio and customer segments before taking decision which can help reducing claim & improve profitability for insurance companies.

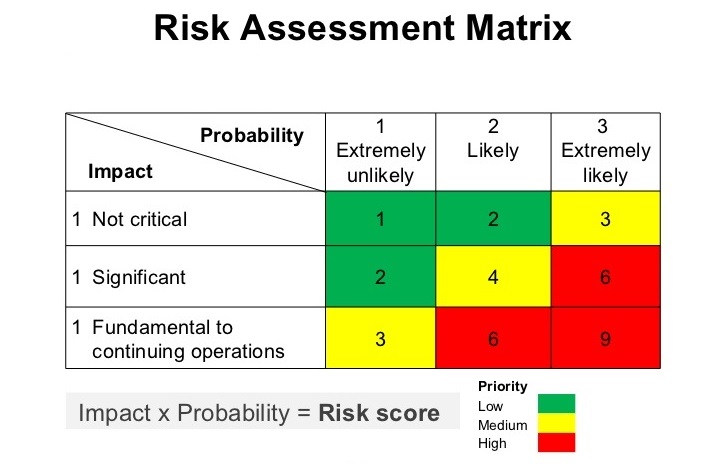

The predictive model of Insurance Analytics (IA+) provide customer risk scoring so that risk can be estimated before underwriting the policy.

- Product line analysis

- Loss Ratio

- Risk cost per Policy

- Expense ratio

Insurance Underwriting Analytics consists of following sub-modules:

- Underwriters Performance Analysis

- Risk Scoring

Underwriter’s Performance Analysis

Underwriting is one of the most critical function of any insurance company. Since underwriting function is managed internally, it’s very essential to measure the performance of individual underwriter to improve their productivity & efficiency. Insurance Analytics (IA+) offers comprehensive analysis on following key metrics in Underwriting Analytics:

Productivity Measures:

- New cases ( proposal) handled by each underwriter per day

- Average time taken to underwrite medical, non medical cases, motor, non motor cases against SLA

- No. of new cases underwritten by each underwriter per day

Quality Measures the No. of Cases

- Underwritten in 1st attempt

- Referred to senior underwriters

- Referred for review

Performance measures

- Top 10 / bottom 10 underwriters on Productivity measures

- Top 10 / bottom 10 underwriters on quality measures

Risk Scoring

While insurance companies are continuously experiencing greater pressure to reduce the turn around time (TAT) of policy issuance. In order to increase the bottom line its very important to analyse customer specific risk parameter before underwriting the cases so that claim cost is under control and profitability is maintained, they are also looking for new approaches & technology to identify the fraudulent claim at the time of claim submission.

GrayMaytter’s Insurance Analytics (IA+) offers Risk Scoring Analytics model using predictive analytics which is primarily used to identify the quantum of risk based on individual customer score. The score is used for underwriting decision and insurance pricing