Overview – Insurance Marketing Analytics

In this competitive business environment, Insurance companies are adopting aggressive marketing strategies for new customer acquisition and existing customer retention. To adapt to the changing market landscape, an organization must monitor changes in buying patterns and behaviour of the customers based on various demographics, geographies & psychographics profile. The analysis of existing customer’s data can through many insights of the customer such as their buying behaviour, buying Pattern, brand loyalty, investment pattern & customer churn. Such insight can be of great help to Marketing Head while devising new Marketing strategy. To improve this situation, GrayMatter’s is providing Insurance Marketing Analytics solution:

Insurance Marketing Analytics covers 4 modules which are as follows:

- New Customer Acquisition Model

- Upsell and Cross sell Analytics Model

- Lapse Prediction Model

- Sales Forecast & Planning

New Customer Acquisition Model

Social Media Lead generation

- Social Media lead generation model is built using advanced statistical models with several linear and non linear variables for likelihood computation

- Customer information are updated by integrating with social media sites such as Facebook, LinkedIn, Twitter etc

Positioning of right product

- Based on various attributes of the prospect, this model recommends which product to be positioned using algorithms and business rules

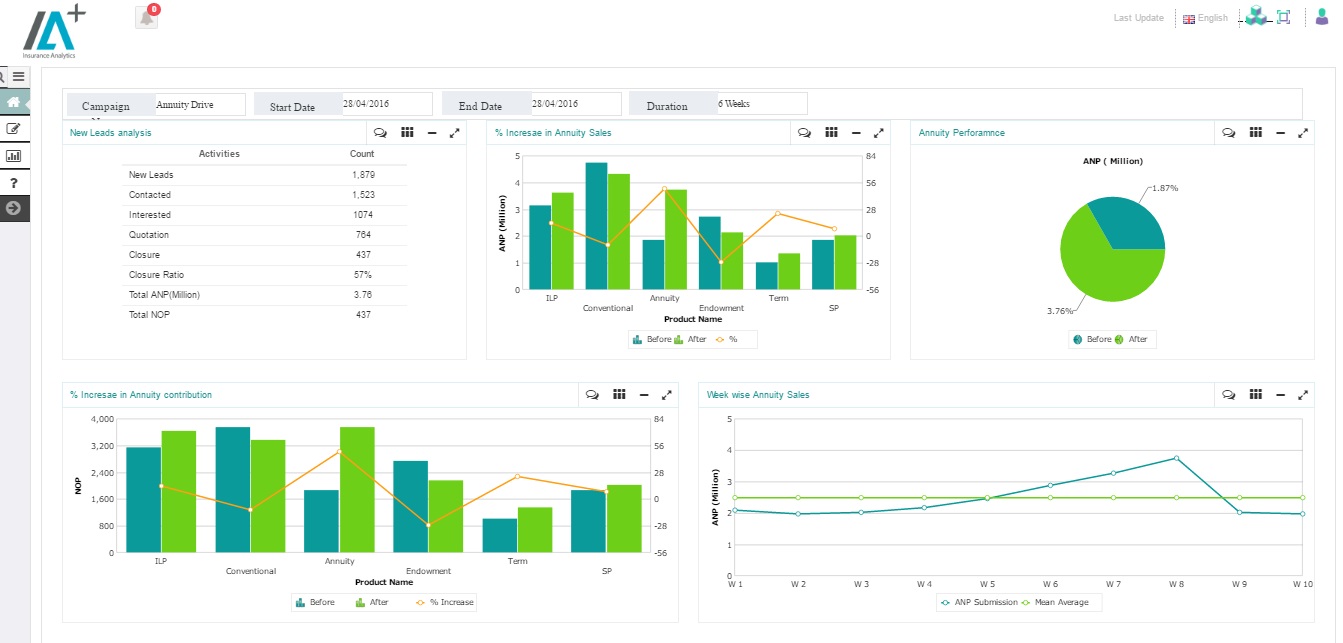

Lead Management

- Complete funnel management from New leads to Closure using probabilistic model

Upsell and Cross Sell Model

Upsell and Cross Sell model is a mathematical pattern based function of independent attributes built using advanced statistical models with several linear and non linear variables for likelihood computation

The following algorithms are used to infer this function

- Logistic Regression

- Random Forest

- Decision Tree

- Clustering

Selection of the algorithm is done as part of model validation using several measurement metrics

Upsell and Cross Sell model recommends which Product or riders to sell to which existing customers, based on buying behaviour of other customer in a similar cohesive group using algorithms and business rules

Insurance Analytics (IA+) Upsell and Cross Sell solution also provides monitoring of success rates of the model and remodeling of algorithms for model optimization

Lapse Prediction Model

- The lapse model predict the likelihood of a customer who will not renew the policy next year

- Lapse model has been built using algorithm such as Decision Tree, Logistic Regression & Naïve Bayes

- This model generate customer scores showing Probability of lapse

- The model also provide agent scoring for lapse

- The solution also provides monitoring of accuracy of this model on a regular basis and remodeling of algorithms for model optimization

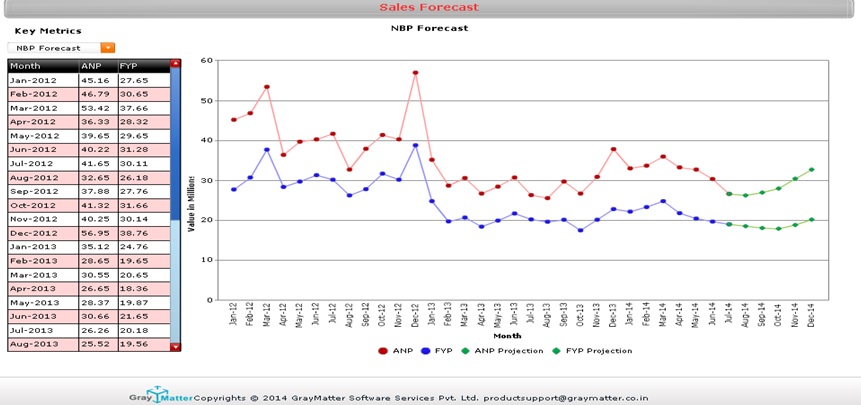

Sales Forecast

- The forecast model is built on data mining tool, Time Series ( ARIMA)

- The forecast model will predict the business for the next 3-6 months based on last 2-3 years performance using variables such as Total manpower ( No. of Agents/ Unit Managers), Active agents, average premium, seasonality etc.

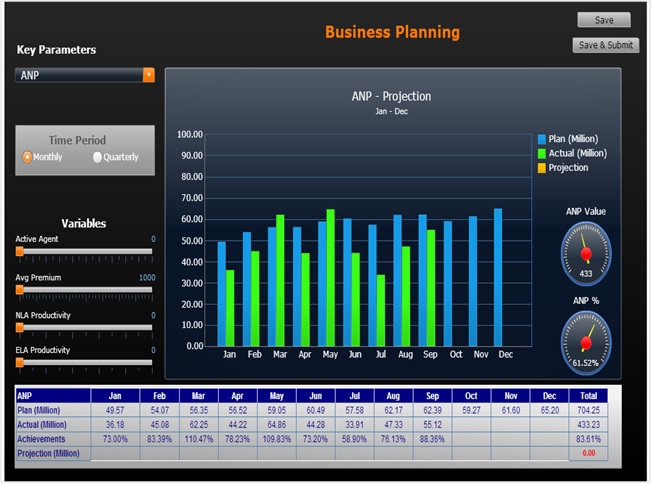

Sales Planning

Business Planning Module is built on What-if analysis principal. Unit Manager / Agency manager can project their business using this tool which gives option to select variables & set the target dynamically for the next month/ next qtr

Unit Manager or Agency Manager can project their ANP / NOP for the next month or next qtr using this planning Module

Variables such as Active Agent, Avg Premium, New Agent productivity & existing Agent productivity can be selected to project ANP for the next period

Once the projection is made, it can be submitted. Supervisor will be able to view the projection on their dashboard and will get rolled up till CAO and CEO