Overview

One of the most important parameter of operations head is to improve Operational efficiency by carefully improving each & every process from proposal submission to policy issuance. The Operations Head has to oversee the processing of large volume of Insurance Proposal with minimal turnaround time (TAT) and better efficiencies. GrayMatter’s IA+ Insurance Operations Analytics covers all the above mentioned areas.

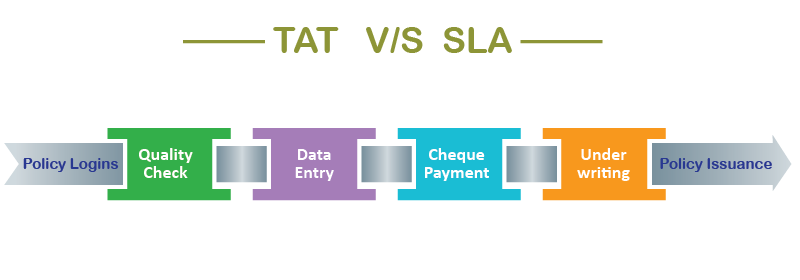

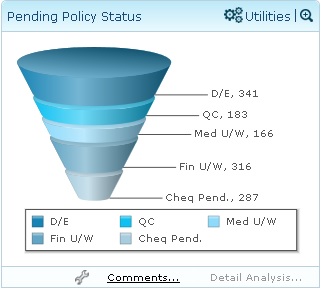

IA+ Insurance Operations Analytics offers comprehensive analysis of Policy processing from Policy logins to Policy issuance. It also offers Manager’s Productivity analysis, customer’s complaint resolution & Turnaround time (TAT).

IA+ Insurance Operations Analytics covers the following metrics:

- New Business Analysis

- Pending Premium Analysis

- New Agent Licensing

- Manager’s Productivity

- Policy Owner Services ( PoS)

- Customer Complaint & Resolution

- Customer Retention Analysis

- Policy Renwal & Persistency Analysis

- Turnaround time (TAT) Analysis

Policy Renewal & Persistency Analysis

Insurance policy renewals depend on various internal & external factors. To analyse the internal factors, we need to understand customer’s attributes, sales agent’s attributes, Product types, premium mode & payment modes. Insurance Analytics (IA+) solutions provide various analysis of customer & sales agents attributes as follows:

- Demographic attributes such as Age, Gender, Education, Profession, annual income etc.

- Geographic attributes such as town, city and country pin code etc.

- Psychographic attributes such as Life style, affiliation, social class etc.

- Behaviour attributes such as Payment mode, payment types, payment during grace period, no. of times policy got reinstated, no. of claims made etc.

Insurance Analytics (IA+) also provides policy renewals analysis based on Product and payment which are as follows:

- Renewals due by Products main class & sub class

- Renewals due by Motor & Non Motor

- Renewals due by Premium mode ( annual mode v/s pay as you go )

- * Renewals due by Payment types (Cash/ cheque, credit cards, direct debit etc.)

Insurance Operations Analytics – TAT Analysis

While insurance companies are continuously experiencing greater pressure to reduce tenting the turn around time (TAT) of policy issuance. In order to increase the bottom line its very important to analyse customer specific risk parameter before underwriting the cases so that claim cost is under control and profitability is maintained, they are also looking for new approaches & technology to identify the fraudulent claim at the time of claim submission.

GrayMaytter’s Insurance Analytics (IA+) offers Risk scoring model using predictive analytics which is primarily used to identify the quantum of risk based on individual customer score. The score is used for underwriting decision and insurance pricing