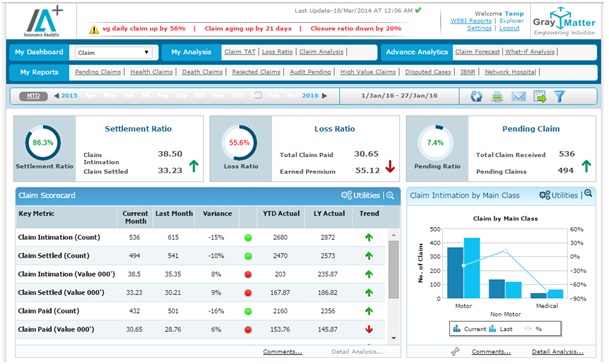

Overview – Insurance Claim Analytics

IA+ Insurance Claim Analytics provides comprehensive analytic solutions for claim department from new claim intimation to claim settlement and loss ratio. IA+ claim analytics also provide employee productivity in terms of No. of claim handled by each executive and time taken to settle the claim against defined SLA. Moreover, IA+ Insurance Claim Analytics also provides various claim efficiency metrics such as

- Closure Ratio Analytics

- Pay-out Ratio Analytics

- Loss Ratio Analytics

Claim dashboard consist of various KPI’s & metrics which is required to be analysed on a daily, weekly, monthly & quarterly basis to improve turnaround time (TAT and overall claim efficiency) which leads to higher customer satisfaction and retention.

IA+ Insurance Claim Analytics consists of following sub modules:

- Activity Management

- Scoring (Fraudulent Claim)

- Forecast & Claim Reserve

- Cost Analysis

- Loss Ratio Analytics

Claim Activity Management

Managing Claim is one of the most complex issue for any insurance company. It involves various activities such as opening, closing & re-opening of claims. This Insurance Claim Analytics module also involve Claim payout, outstanding and claim reserve. IA+ offers comprehensive analysis on following key metrics:

- Settlement Ratio

- Payout Ratio

- Repudiated Ratio

- Loss Ratio

- Ageing Analysis

Insurance Analytics (IA+) also provides comparison with previous month / quarter and year against the actual claim to analyze the efficiency & productivity of claim department.

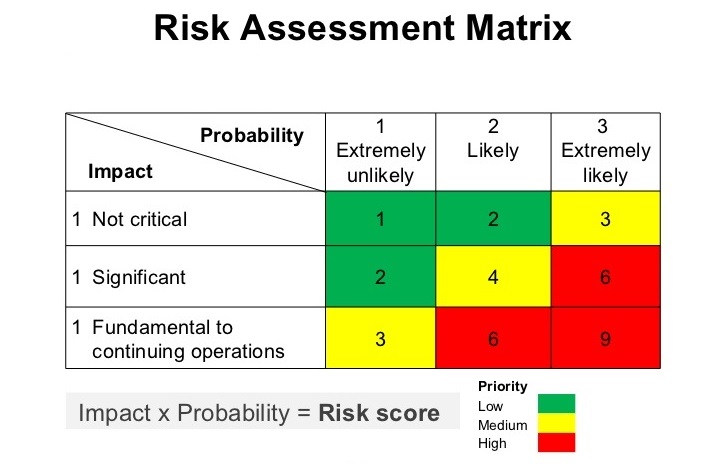

Claim Scoring

It has been estimated that fraudulent claim costs Insurance Industry billion of dollars annually. The increasingly high prevalence of fraud is one of the main contributing factor driving up the combined loss ratio. While insurance companies are continuously experiencing greater pressure to reduce overall claim expenses in order to increase the bottom line, they are also looking for new approaches & technology to identify the fraudulent claim at the time of claim submission.

GrayMaytter’s Insurance Analytics Software offers claim scoring built using predictive model which is primarily used to detect the malpractices & fraudulent claim based on individual customer score. Claim scoring are also used to score service providers, garage and hospital.

Claim Forecast

Claim forecasting is used to predict the future claim so that appropriate reserves can be created to meet such obligation. However, forecasting of claim is not only based on past trends but it depends on various external factors which need to be considered in the model.

Insurance Analytics (IA+) Claim Forecast model address the following questions

- How many claims would be recorded in next 6 months if last 12 months Claim trend continue

- What factors are impacting the forecast model

- How much reserves is required to be maintained if claim continue to grow with the same rate

- What would be the impact on total claim reserves if motor claim increases by “x” %