Actuarial Analytics Overview

The actuarial department is responsible for collecting various information that goes into calculation of insurance premium, determining the adequacy of reserves to meet the firm’s obligations to policyholders under the policy contracts, determine the premium rate of new policies that will be of benefit to the insurer, assist corporate management in developing the strategic plan, establishing goals and objectives and meeting the firm’s external obligations to regulatory authorities. GrayMatter’s Insurance Analytics team provide Actuarial Analytics to resolve all this.

Insurance Analytics (IA+) Actuarial Analytics provide experience study to enhance Actuarial team’s ability to strategically plan their product pricing & reserves which is aligned to all the stakeholders including policy holder. The key metrics of Insurance Analytics (IA+) offers the followings:

- Experience Analysis

- Lapse Rate

- Surrender Rate

- Withdrawal Rate

- Mortality Rate

- Morbidity Rate

- Loss Ratio

- Customer Scoring (Risk Profiling Analysis)

- Loss Ratio Analysis

- Product Profit Analysis

Experience Study

Experience study provides various information about the policy holders which are keys to decision making for product pricing & reserve. The key metrics are as follows:

- Lapse Rate Analysis

- Surrender Rate Analysis

- Withdrawal Rate Analysis

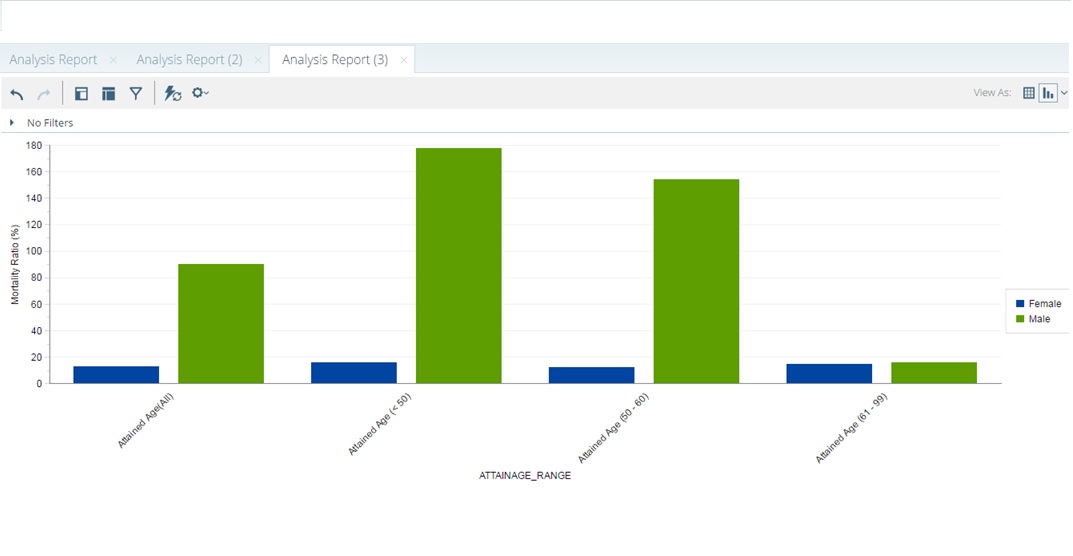

- Mortality Rate Analysis

- Morbidity Rate Analysis

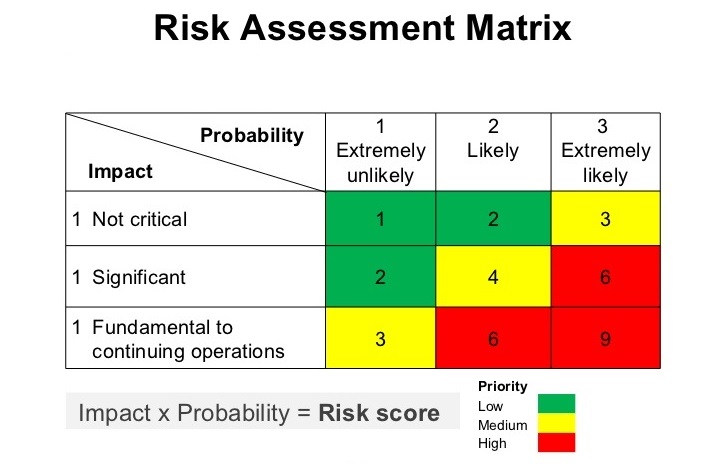

Customer Scoring

Customer scoring technique are primarily used to assess the risk of an individual customer based on various demographic, geographic & behavioral attributes. Statistical models are used to determine the customer score and the premium rate is fixed accordingly. This techniques helps Actuarial team to price the risk appropriately.

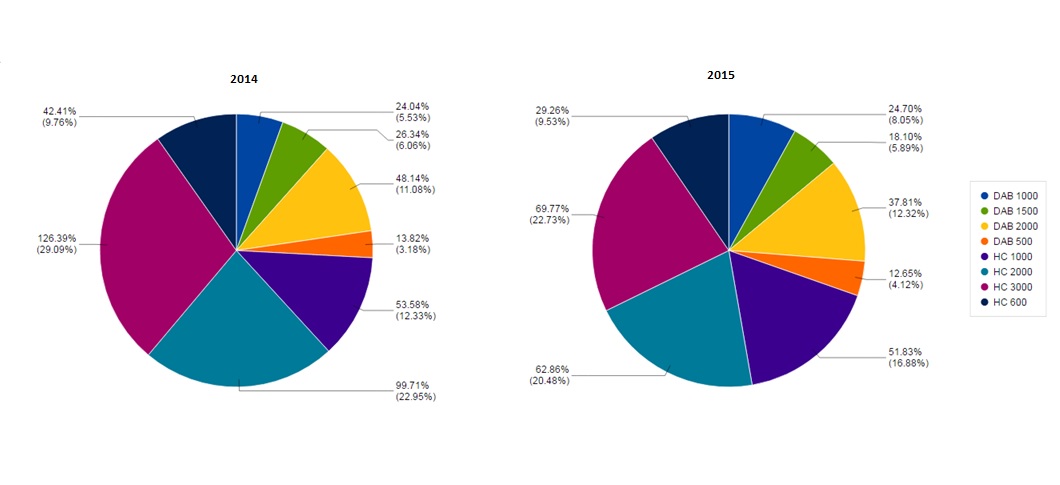

Loss Ratio Analysis

The difference between the ratios of net premiums received by an insurance company and total claims paid. The loss ratio shows what percentage of payouts is being settled with the recipients.

- The lower the loss ratio the better – higher loss ratios may indicate that an insurance company may need better risk company may need better risk management to guard against future possible insurance payouts.

Loss Ratio Analysis helps Actuary to know

- How much reserves is required to be maintained if losses continue to grow with the same rate

- What would be the impact on total claim reserves if claim increases by “x” %