Insurance Sales and Distribution Analytics – Overview

Insurance industry by far has the most competitive business environment and the Sales and Distribution Channel is one of the key functions to the overall growth. Maximizing growth in the insurance industry depends on effectively managing multiple distribution channels and intermediaries. To cover all these GrayMatter’s providing IA+ Insurance Sales and Distribution Analytics.

GrayMatter’s IA+ Insurance Sales and Distribution Analytics covers all distribution channel such as Agency, Bancassurance, Broker, Corporate, Direct & Online sales Channel. It provides end-to-end sales management solution which helps in devising intelligent distribution strategies, effective channel management, lead management, channel productivity, recruitment, training effectiveness & Sales contest management. Insurance Analytics (IA+) also provides advance analysis for Up-Sell/ Cross Sell, Campaign managements and Sales planning & forecasting.

GrayMatter’s IA+ Insurance Sales and Distribution Analytics consists of following sub-modules:

- New Business

- Renewals & Persistency Management

- Recruitment & Manpower

- Lead Management

- Sales Contest Analysis

- Training Effectiveness

- Sales Forecasting & Planning

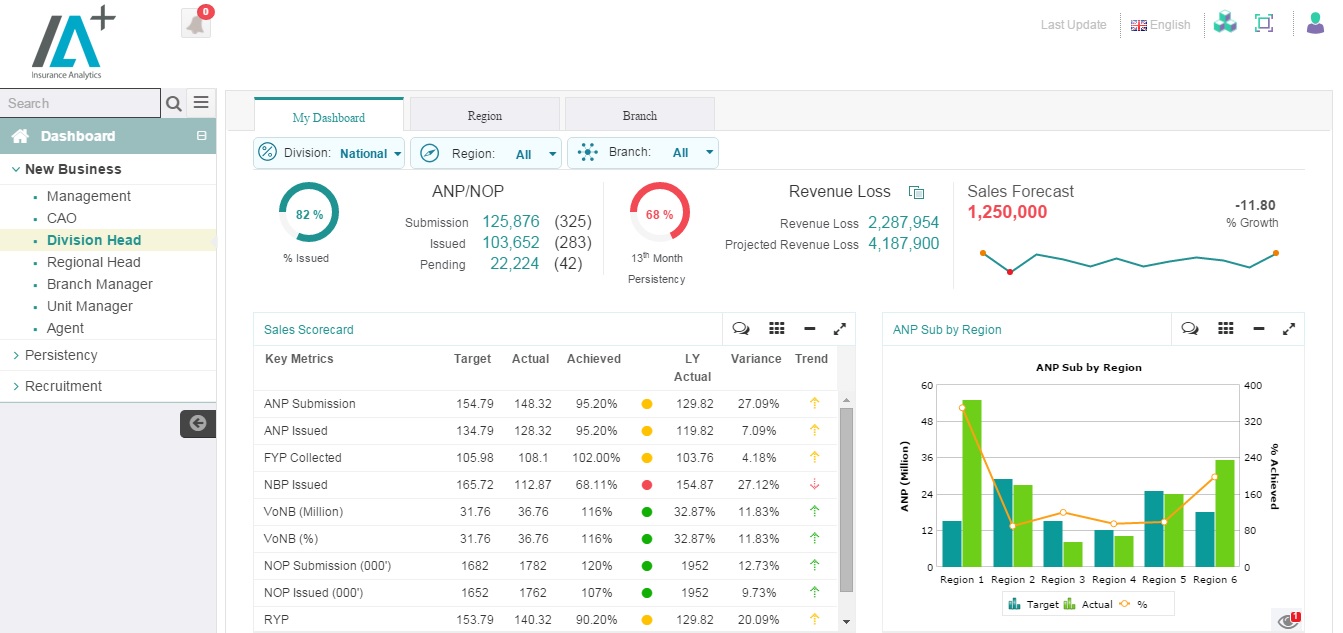

New Business

Sales & Distribution channel primarily drives new business in terms of Annualized Net Premium (ANP), Gross Written Premium (GWP), First Year Premium (FYP), New Business Premium (NBP), Number of Policy (NOP) & Riders contribution percentage to policy base premium. Insurance Sales and Distribution Analytics module also helps in analyzing new business by distribution channel, geography, Product Class / sub class, modal premium and provide comparison with previous month/ Qtr/ Year and MoM/ QoQ/YoY growth trend

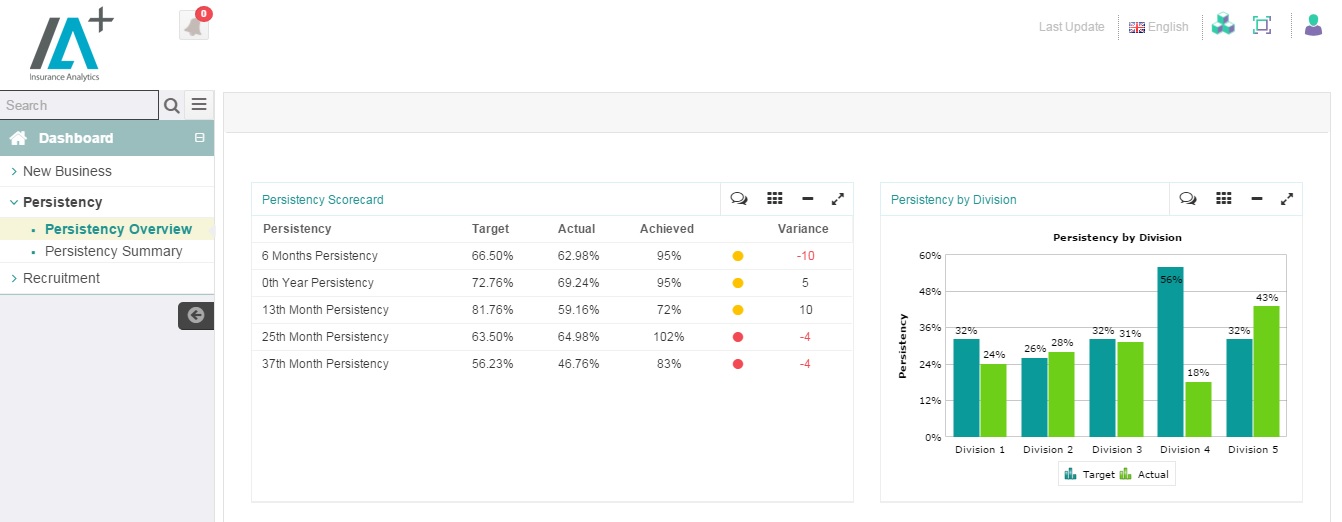

Renewal & Persistency Management

Insurance is a long term contract between the Insured person or Insured goods or services and the Insurance Companies. Hence, policy renewals / persistency determine the profitability of Insurance companies.

Insurance Analytics (IA+) provides various analysis towards Renewals / Persistency such as persistency by

- Products main class & sub class

- Modal premium (Monthly/ Quarterly / semi-annual & annual)

- Payment like cash/ cheque, credit cards, direct debit etc.

- Policy tenor

- Individual producers/ corporate agents & broker

- Customer profile (demographic, geographic & behavioural)

Recruitment & Manpower

Traditionally, individual agents/producers contributes 50% – 80% of Insurance premium. Unit Managers spends most of their time in recruitment & development of agents / producers. Insurance Analytics (IA+) provides various analysis towards Recruitment’s & manpower

- Recruitment analysis (Opening count, New recruitment’s, Attrition, total manpower)

- Agency segmentation (Age group, Gender, profession, Race, city, town, etc.)

- Agent category (New recruits, existing agents, NDRT, COT, TOT etc.)

- Attrition Analysis (0-3 months, 3-6 months, > 1 year)

- Recruitment & Attrition trend

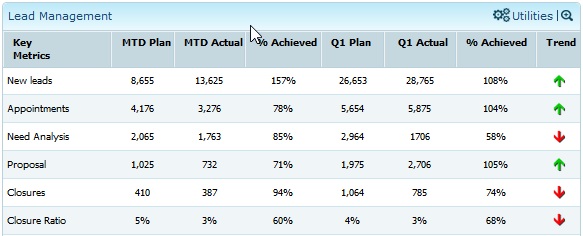

Lead Management

Effective management of sales pipeline is as important as generating new leads. Insurance Analytics (IA+) lead management analytics provide complete funnel management from new leads to closure and closure ratio.

Mobile apps developed for Sales Activity Management (SAM) helps in monitoring the total active leads in the system as well as it gives the status of sales pipeline at various stages from appointments to need analysis, proposal & closure by agents & unit manager on a daily/ weekly/ monthly basis against the target.

Training Effectiveness

Insurance Analytics (IA+) offers comprehensive analysis for training effectiveness in terms of measurable improvements in performance after training

- No. of Training conducted in a month/ Qtr

- No. of Agents/Unit Manager attended the training

- Average Performance before training

- Average Performance after training

- Percentage growth in performance

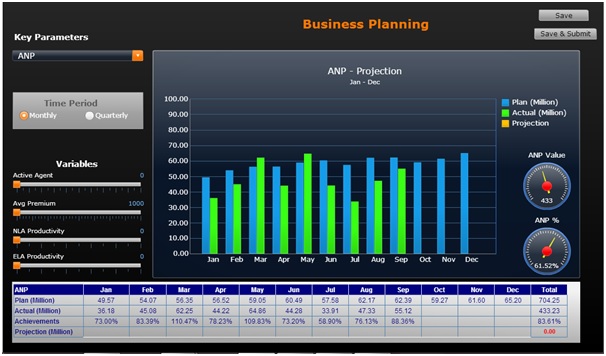

Sales Forecast & Planning

GrayMatter’s IA+ Insurance Sales and Distribution Analytics offers Sales forecast & Planning application where each Unit Manager/ Agency Manager can project their new business( ANP/ FYP/GWP/ NOP) based on their past trends and forecast. The projected number will be automatically rolled up to the respective supervisor who can measure their team performance against the projection and also track their input activities